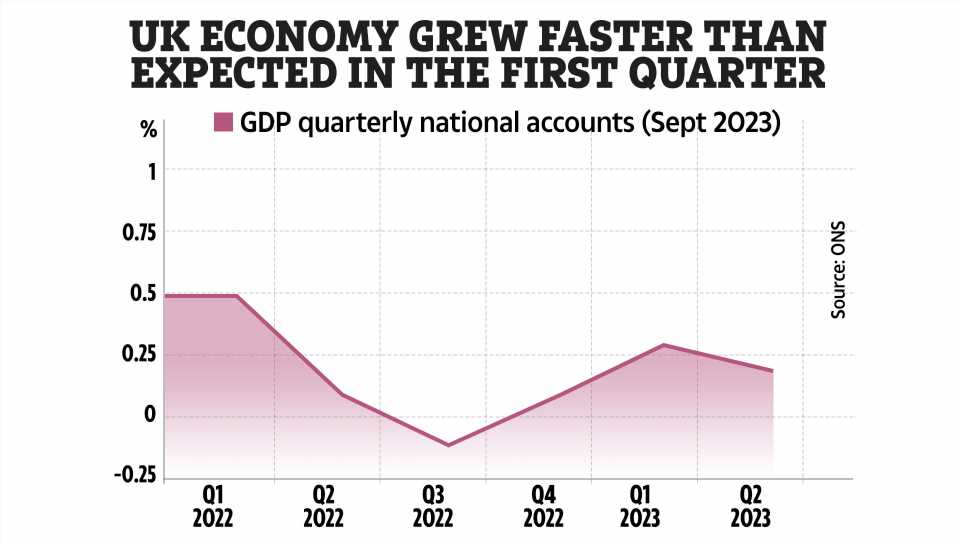

THE UK economy grew faster than expected between January and March this year, revised figures have suggested.

The Office for National Statistics (ONS) said that it now thinks that gross domestic product (GDP) rose by 0.3% in the first three months of the year, up from the 0.1% previously estimated.

GDP measures the value of goods and services produced in the UK.

It also estimates the size and growth of the economy.

It means that the UK economy is now expected to have grown by 1.8% between the final quarter of 2019, before the pandemic hit, and the second quarter of this year.

It comes following a series of revisions to GDP estimates, which were made much more difficult during the pandemic and energy crisis.

Read more in money

Major energy supplier to slash bills after Martin Lewis demanded change

Eight freebies and discounts worth £6k you can get on Universal Credit in October

The ONS made the revisions after getting access to new data. Taken together, recent revisions mean that GDP is around 2% higher than it had thought to be previously.

The upgrade to the first quarter of this year was largely because of new data from the health and education sector and revised VAT figures, the ONS said.

Earlier this month, the ONS said that it now thinks GDP returned to its pre-pandemic level by the last three months of 2021, much earlier than first thought.

ONS chief economist Grant Fitzner said: "Our new estimates indicate a stronger performance for professional and scientific businesses due to improved data sources.

Most read in Money

Martin Lewis’ MSE reveals how to get FREE meal at Greggs – but you must be quick

High Street giant uses cardboard cutouts of booze as shoplifting spirals

Cadbury chocs popular in Australia hit UK shelves – but fans say same thing

Shoe shop to shut store for good as string of locations have already disappeared

"Meanwhile, healthcare grew less because of new near real-time information showing the cost of delivering services."

Chancellor of the Exchequer Jeremy Hunt said: "Since 2020 we have grown faster than France and Germany.

"The best way to continue this growth is to stick to our plan to halve inflation this year, with the IMF forecasting that we will grow more than Germany, France, and Italy in the longer term."

Rishi Sunak has said that new figures suggesting that the economy grew faster than expected between January and March proves the doubters wrong.

The Prime Minister wrote on social media: “People doubted the strength of the UK economy – today’s data proves them wrong.

“We’re sticking to the plan to halve inflation and grow the economy.

“You can trust me to get it done.”

What does it mean for my money?

A healthy economy is one that is growing and not in recession so the latest figures should be good news for consumers.

A country is in recession if there are two consecutive quarters of Gross Domestic Product (GDP) falling.

The year is split into four three-month quarters.

The economy remained unchanged in the three months to March, which means a recession was avoided.

Recessions are bad news because it usually means jobs will be lost and wages will stall.

It can cause businesses to go into administration or bust too.

This, in turn, means the government gets less tax, which could mean cuts to public services and benefits such as Universal Credit. Tax rates might go up too.

The UK last went into recession in 2020 after the coronavirus pandemic hit, shutting down large parts of the economy.

How to protect your finances

If you're worried about your finances, there are steps you can take to try and keep your cash safe.

Having an emergency savings pot is helpful in times of high inflation, to help cover any outgoings that might have increased unexpectedly.

You might consider asking for a pay rise at work, but there are no guarantees your company is in a position to offer one.

Be sure to make savings where you can – shop around for better deals on your car and home insurance, as well as broadband and mobile phone.

Save money by going to a cheaper supermarket, shopping for own-brand rather than premium products, and looking out for yellow-sticker bargains.

Make a budget and check your bank statements for any forgotten subscriptions you might be wasting money on.

Making extra cash in your spare time can help too, picking up a side hustle or selling your old clothes could give you a boost.

A woman recently told The Sun her £7,000 a month side hustle lets her make cash from her sofa – but some thinking its a boring chore.

From being paid to watch movies to recycling old till receipts here are 20 easy side hustles you can do at home and make money.

When money is tight, it can be tempting to ignore debts – but this will only make your financial situation worse.

Stay on top of what you owe and always repay priority debts.

There are also plenty of organisations where you can seek debt advice for free.

These include:

- National Debtline – 0808 808 4000

- Step Change – 0800 138 1111

- Citizens Advice – 0808 800 9060

You should also check what benefits you are eligible for.

Entitledto's free calculator works out whether you qualify for various benefits, tax credits and Universal Credit.

If you don't want to register, consumer group MoneySavingExpert.com and charity StepChange both have benefits tools powered by Entitledto's data that let you save your results without logging in.

There is also emergency funding available for struggling households, which is dished out by local councils.

The Household Support Fund is designed to help those in most need with payments towards the rising cost of food, energy, and water bills.

READ MORE SUN STORIES

I'm a cleaner, 5 things I'd never put in my house – including a kitchen handle

Paris Fury shares sleepy selfie & baby update after day of 'normal life'

Help available varies, but you could get free cash, food vouchers, and help for bills like rent and energy.

You could also get similar help from your council under the welfare assistance scheme.

Source: Read Full Article